Personal Wealth Management / Economics

Retail Down, Services Up?

It looks like spending is starting to shift back from goods to services.

Pop quiz: When is it good news that US retail sales fell -1.3% in a given month?[i] Answer: When that drop happens in May 2021 because more businesses have reopened nationally. Now, if you haven’t come across the wide range of solid news coverage of this report (some of which we highlighted in today’s What We’re Reading), it might seem counterintuitive that sales would drop as businesses reopen—common sense suggests it should be the opposite, presuming people have pent-up demand to unleash and savings aplenty. But the businesses that feed into the retail sales report were already pretty much fully open, albeit with some lingering capacity constraints. In May, reopening’s fruits spread to the broader services sector, and people shifted spending accordingly. Now, all of this is old news to stocks, which have anticipated the long reopening journey for well over a year now. But a quick look at US consumer spending’s breakdown can help investors put the latest news in context.

As its official name (Monthly Sales for Retail Trade and Food Services) suggests, the retail sales report includes household spending at stores and restaurants. “Stores” includes all of the usual suspects: grocery stores, department stores, boutiques, sporting goods stores, clothing shops, e-commerce, auto dealers, auto parts stores, gas stations, furniture stores—basically, anywhere you can walk in (or click to) and buy physical goods. Altogether, these accounted for 31.9% of pre-pandemic household spending.[ii] Food services accounted for another 7.1%.[iii] That means just over 60% of consumer spending isn’t captured in the retail sales report.

That 60-plus percent is what got a lift from vaccines and eased restrictions on travel and leisure in May. You can see hints of this in the retail sales report, which shows sales at restaurants and bars up 1.8% m/m.[iv] Sales at clothing stores rose 3.0% as people finally had places to go.[v] That all points to improvement in travel- and event-related spending, which should boost services categories, including accommodations, transportation and recreation. Broader services’ reopening also points to a recovery in elective and non-emergency medical care, which is a good-sized chunk of overall services spending.

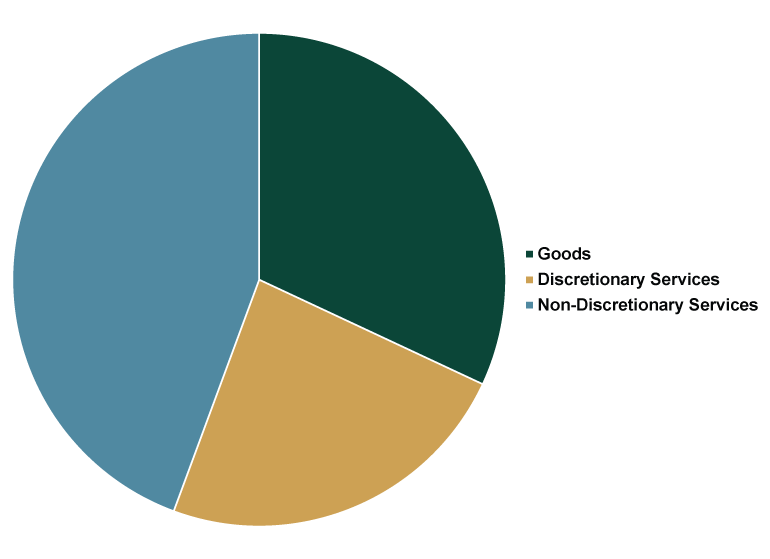

To see this another way, consider Exhibit 1, which breaks down pre-pandemic consumer spending (excluding spending by non-profits) into broad categories: Household spending on goods, non-discretionary services (e.g., housing, utilities, nursing homes and financial services) and discretionary services. As you will see, nearly one-fourth of household spending likely stands to benefit from continued easing of restrictions over the next couple of months.

Exhibit 1: A Broad Household Spending Breakdown

Source: US Bureau of Economic Analysis, as of 6/15/2021. Personal Consumption Expenditures by Type, 2019.

There is still a good amount of ground to make up in that big yellow slice. In Q1, transportation, recreation, food service and accommodations were all down double-digits from their Q4 2019 highs. We aren’t arguing they will all skyrocket in Q2 and Q3—or that any bump will be long lasting. But if people spent less on goods last month and more on travel and leisure, that is just one more sign of a nascent return to normal. That also suggests that, for the next few months especially, investors probably benefit from not overrating the retail sales report—it likely won’t include the categories where the real spending action will probably be happening.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.