Personal Wealth Management / Market Analysis

#Tweet #Retreat

The blame for this week’s “tweet retreat” has been pinned on high frequency trading and the need for more regulation to smooth out such volatility. But for long-term, goal-oriented investors, some reflection on the last “flash crash” should give pause for consideration.

To trade or to tweet? Source: Getty Images.

Tuesday morning, the Associated Press’s Twitter account was hacked, and the twitter twits responsible tweeted (or in non-tech savvy parlance, reported) an explosion at the White House injured President Obama. In the next three minutes, broad US markets dropped roughly 1% before quickly recovering to previous levels (then finishing the day nicely positive). Blame was widely directed at algorithmic and high frequency trading (HFT) using “tweets” (including the aforementioned hacked tweet) to execute trades, a lack of human control to recognize fake tweets/information and a dearth of regulations to prevent such volatility.

For many folks, this dredged up memories of 2010’s “flash crash,” when broad US markets shed about 8% in three minutes before recovering to finish the day down only 3%. Then too, blame was heaped on the advent of high frequency trading and the need for more regulation to eliminate intense volatility from super-fast trades. But countless Congressional hearings, regulatory meetings and changes later, Tuesday’s “tweet retreat” still happened. Why? And what can long-term, goal-oriented investors take away from this?

First, regulation has, so far, proven not to be a very effective solution—if there is in fact a problem. As we pointed out a year after the flash crash, we’re all for effective regulation that ensures greater transparency. But market circuit breakers, single stock circuit breakers, curb-ins, etc., installed after 2010 still failed to prevent Tuesday’s tweet retreat. Perhaps there’s just no regulatory solution to mitigate away all market volatility.

Should we instead just shun newer technology? Probably not. Since the days of trading near the bottom of the buttonwood tree, markets have adapted to and utilized technology. Markets adapted to the telegraph, the telephone, the Internet, and they will, over time, adapt to Twitter and whatever comes next too. New technology can be disruptive—for awhile. But the net benefit of increased transparency and speedier price discovery results in narrower bid-ask spreads and ultimately benefits all investors.

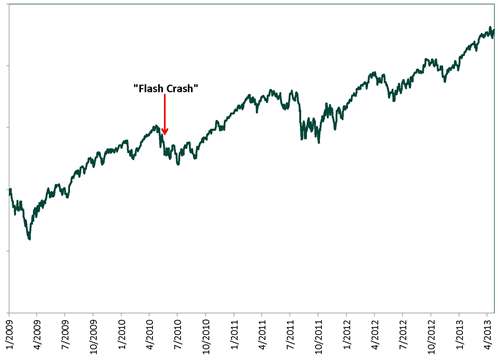

But, let’s be clear, a 1% move one way or another in the market in a relatively short period of time is not unprecedented. In fact, such volatility is quite regular—regardless of the culprit. Volatility in the short term has always and forever been a part of dealing with markets. But volatility is just as often good as it is bad. In the shorter term, while the negative, downward volatility is uncomfortable and elicits the reactions we saw Tuesday, our brains far too easily to gloss over the greater frequency of positive volatility moving markets up over the long term—myopic loss aversion at work. To illustrate the importance of thinking long term, one need only look at what the market has done since 2010’s flash crash. (See Exhibit 1.) Hindsight shows the flash crash (and myriad other short-term negative volatility) was a non-event for disciplined, long-term investors.

Exhibit 1: S&P 500 Total Return

Source: Thomson Reuters, reflects S&P 500 Total Returns.

So, could another “flash crash” happen? Sure. But the effects are over and done too quickly. If you’re working with long-term capital, trying to predict and avoid it seems an effort in futility.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.