Retirement Financial Planning: Considerations

Even the most thorough retirement financial planning cannot account for every possibility. After all, it’s possible you could live to be 110! Or you could win the lottery!

While these events are possible, they aren’t probable. Still, quality financial retirement advice accompanied by sound investment management can help you prepare for a mostly carefree retirement. Here are a few retirement financial planning matters to consider while creating your retirement financial plan.

Inflation Erodes Purchasing Power Over the Long-Term

Inflation is the general increase in prices that reduces the purchasing power of a dollar. If inflation increases, a dollar could purchase fewer goods and services several years from now. If you want to maintain your pre-retirement income, your investment returns must match or outpace inflation.

Consider that since 1925, the United States’ average annualized inflation rate was 2.9%.1 Look at Exhibit 1 to get a sense of how inflation could affect your retirement financial situation. This table shows how inflation erodes the purchasing power of $10,000 over 30 years under a hypothetical 2.9% inflation rate.

Exhibit 1: Hypothetical 2.9% Annual Inflation More Than Halves Purchasing Power of $10,000 Over 30 Years

Hypothetical inflation example based on an assumed inflation rate of 2.9%.

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.

Proper Estate Planning Can Help Save Your Heirs Time and Heartache

Another consideration for your retirement financial planning is how you want to eventually distribute your retirement savings when you’re gone. Specifying what will happen to your estate after you pass away can help give your loved ones peace of mind when they need it most. If you pass away without a will, living trust or other estate-planning document, the court system may be responsible for dividing your estate and deciding who will receive your assets.

Insufficient financial retirement advice—or worse, none at all—can add stress during an already trying time. Though it may take some forethought and paperwork now, you and your beneficiaries benefit if you have a clearly defined plan that aligns with your goals. You can start the process as early as you like.

There are many ways to design and implement your estate plan. The best way for you largely depends on your individual situation. You could use a financial advisor, retirement financial planner or someone who specializes in estate planning. Whoever it is, you can get a head start by thinking about a few things:

- How much money do you want to pass on?

- How will your assets transfer upon death?

- Will you accomplish your estate plan through a will, trust, beneficiary designation, or some other means?

- When should the transfer take place?

Insurance Can Help Pay for Retirement Expenses

Life insurance and long-term care insurance are important topics to consider when planning your retirement. You may want life insurance to provide for a spouse or children in the event of your death. Or you may want long-term care insurance if you suffer a protracted illness and need to ensure serious financial burdens don’t fall on your loved ones. Or you may want both!

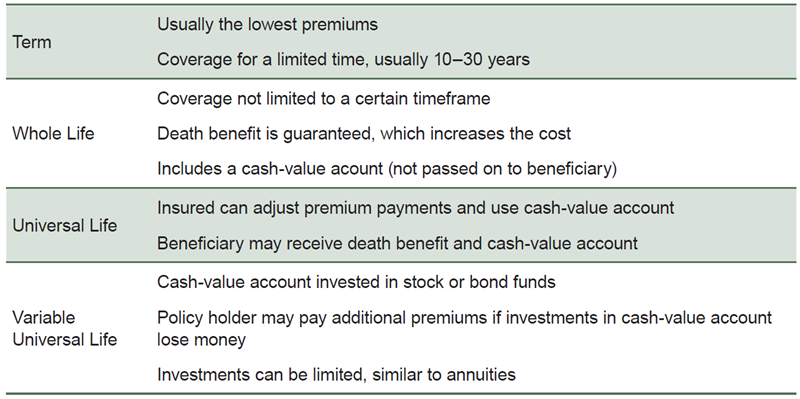

Many types of life insurance exist to fit your individual needs, ranging from simple and inexpensive to complex and expensive. Exhibit 2 details a few options you might consider.

Exhibit 2: Types of Life Insurance

Long-term care insurance can also be an important retirement financial planning option. You might end up with a disability or health issue in later life that requires long-term assistance. Medicare and health insurance may not cover all of your future care costs. Long-term care costs pose a significant out-of-pocket expense, and without insurance or another means to pay for these costs, you may risk running out of money before you intend to.

Here are some factors to consider when determining whether long-term care insurance is right for you:

- Can you afford future care costs out of pocket?

- What exactly does your policy cover?

- Will your benefits keep pace with inflation?

- What are your policy’s benefit triggers and waiting periods?

Long-term care insurance may or may not be appropriate for you. Carefully consider your personal financial needs when evaluating how you might use these insurance options.

Don’t Forget About Social Security Income

If you are eligible for Social Security retirement benefits , deciding when to start receiving those benefits is another important retirement financial planning consideration. The longer you wait to receive benefits, the more benefits you’ll likely receive. You may begin receiving benefits as early as age 62, but your benefits will be permanently reduced by a certain percentage for each month below your full retirement age. Your full retirement age depends on your birth year and currently ranges between 65 and 67 years old. If you are still working and don’t need the extra money, it’s likely a disadvantage to begin taking Social Security benefits—not only because of the permanent reduction of benefits, but also because you are more likely to be taxed, depending on your income level.

If you can delay taking benefits until your full retirement age, you can receive your full benefit amount. What’s more, the longer you wait, up until age 70, your benefits may increase. If you are able to begin taking your benefits at your full retirement age or later, the difference in payments can make a significant impact in meeting your income needs and expectations in retirement.

While waiting to take Social Security benefits can increase the amount you receive, doing so will cause you to miss out on payments. All else being equal, waiting can be beneficial for people who expect to live longer than the government’s life-expectancy estimates, while taking your benefits earlier can be beneficial for people who anticipate a shorter life expectancy.

Steady Income in Retirement Is Essential

How much money do you expect to receive from all your sources of income and cash flow after you retire? First, note that income and cash flow aren’t the same. Income is money received (e.g., employment, stock dividends, bond coupon payments). Cash flow is money withdrawn from your portfolio after selling a stock or other security, which for most is a very important component of a retirement financial planning strategy.

When planning how to fund your desired retirement lifestyle, you should include investments, pensions, retirement accounts, annuity payouts and Social Security benefits. Some income sources, such as pensions, may pay out a specified amount each month. Other income sources, such as individual retirement accounts (IRAs), can allow for more flexible withdrawals. Consider what forms of income and withdrawals you may need throughout your retirement. Additionally, be aware of any required minimum distributions. These may be applicable to some or all of your retirement accounts.

We suggest you first calculate all of the income you generate without relying on your investment portfolio. The most common categories of non-investment income include:

- Job salary

- Pension

- Social Security

- Real Estate

After calculating your non-investment income, you can then calculate any additional income you may need from your investment portfolio. More on how you should think about portfolio withdrawals is ahead. Here are a few common sources of investment income you might consider using in retirement:

- Selling stock

- Bond coupons

- Stock dividends

- REITs

- Annuities

It’s wise to diversify your income sources so you don’t put all of your eggs in one basket. Some of the income sources we’ve just covered may be applicable, but it can be overwhelming to figure out which is right for you. That’s where a skilled retirement financial planning advisor can help.

Personal income taxes and capital gains taxes can have an impact on your investments and retirement income. Keep in mind that different income source or types of accounts may have different tax treatments. For example, Roth IRA withdrawals are treated differently than traditional IRA withdrawals. Retirement income taxation can be complicated, so you should consult a tax adviser for your specific situation.

Portfolio Withdrawals During Retirement

If you rely fully or partially on portfolio withdrawals to support your retirement, you need to know how much you can take without risking premature portfolio depletion. In general, we believe it’s prudent to keep your annual portfolio withdrawals to no more than 5%.

Many investors assume that since stocks' average annual return is roughly 10%, it’s okay to withdraw 10% each year without reducing principal. However, this approach will likely jeopardize your retirement lifestyle. Yes, historical average annualized stock returns are around 10% over time, but the key word is "average." In any given year, stock returns can be higher or lower than 10%, sometimes by a lot.

If you take too much money during a market downturn, your risk of running out of money in retirement increases substantially. For example, if your portfolio is down 20% and you take a 10% distribution, you will need about a 39% gain just to get back to the initial value.

Discretionary and Non-Discretionary Spending

You should also consider the trade-off between discretionary (nice-to-have) and non-discretionary (must-have) spending.

Non-discretionary spending isn’t something you have a lot of control over. Examples include living expenses, debt, taxes, insurance and health care. After covering required expenses, you’ll have money to put toward discretionary spending.

Discretionary examples include travel, hobbies, luxuries, charitable giving and helping children/grandchildren. Other discretionary examples that may not immediately come to mind when thinking about retirement include relocating or downsizing, which includes real estate brokerage fees, moving costs, etc.

To meet your retirement goals, you’ll need to understand what you can afford and what, if any, trade-offs you need to make. This doesn’t mean you can’t enjoy your nice-to-haves; after all, that’s what retirement is about for most people. Rather, your budget for these items should include consideration of your must-haves and long-term retirement financial planning goals, cash-flow needs and return expectations.

How Fisher Investments Can Help

We have helped many investors throughout their retirement financial planning journey. There are many factors to consider, whether you are pre-retirement, planning to retire soon, or are already retired. To learn more about Fisher Investments and how we can help you, no matter where you are in your retirement planning process, contact us today.

1Source: United States Consumer Price Index; Global Financial Data as of 3/8/2024. Inflation rate was 2.94% based on US BLS Consumer Price Index from 12/31/1925 to 12/31/2023.