Institutional Investing / Economics

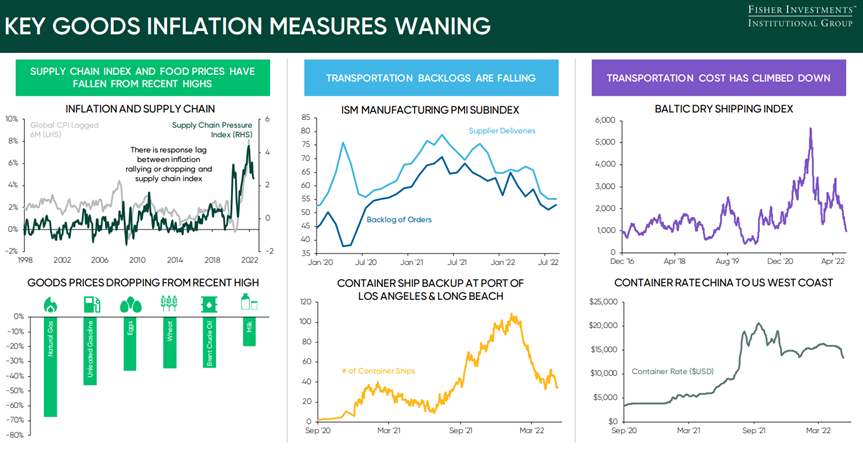

Infographic: Key Goods Inflation Measures Waning

To share this infographic on your website, use the embed code provided below.

Key goods inflation measures appear to be waning as supply chain index, transportation backlogs, and transportation costs fall from recent highs.

Key goods inflation measures appear to be waning as supply chain index, transportation backlogs, and transportation costs fall from recent highs.

Fisher Investments (FI) is an investment adviser registered with the Securities and Exchange Commission. As of August 31, 2022, FI managed $172 billion, including assets sub-managed for its wholly-owned subsidiaries. FI and its subsidiaries maintain four principal business units - Fisher Investments Institutional Group (FIIG), Fisher Investments Private Client Group (FIPCG), Fisher Investments International (PCGI), and Fisher Investments 401(k) Solutions Group (401(k) Solutions). These groups serve a global client base of diverse investors including corporations, public and multi-employer pension funds, foundations and endowments, insurance companies, healthcare organizations, governments and high-net-worth individuals. FI’s Investment Policy Committee (IPC) is responsible for investment decisions for all investment strategies.

The information in this document constitutes the general views of Fisher Investments and its subsidiaries and should not be regarded as personalized investment advice or a reflection of the performance of Fisher Investments or its clients. We provide our general comments to you based on information we believe to be reliable. There can be no assurances that we will continue to hold this view; and we may change our views at any time based on new information, analysis or reconsideration. Some of the information we have produced for you may have been obtained from a third party source that is not affiliated with Fisher Investments. Investments in securities involves the risk of loss. Past performance is no guarantee of future returns. Data is in USD unless stated otherwise.

- Top Left Source: FactSet, as of 06/30/2022. Global CPI data shown as the GDP-weighted year-over-year change in most recent available CPI data for the top 30 countries by GDP, as of 12/31/2021. Global Supply Chain Pressure Index, monthly, 01/01/1998 – 06/30/2022

- Bottom Left Source: FactSet, as of 09/08/2022. Percent change of daily closing prices since 2021 – 2022 peaks of natural gas (Henry Hub spot price, peak 02/17/2021), unleaded gasoline (S&P GSCI unleaded gasoline spot price, peak 06/06/2022), eggs (large, white, USDA, cost per dozen, peak 07/25/2022), soft red wheat (peak 05/17/2022), Crude Oil Brent Global Spot Intercontinental Exchange (peak 03/08/2022) and milk (grade A, peak 02/14/2022) through 09/07/2022.

- Top Center Source: FactSet & Institute for Supply Management, monthly, 12/31/2019 – 08/31/2022.

- Bottom Center Source: Marine Exchange of Southern California, 09/01/2020 – 05/06/2022.

- Right Top Source: FactSet, daily, 12/31/2016 – 08/31/2022.

- Right Bottom Source: Freightos, China/East China to US West Coast, 09/01/2020 - 05/10/2022.

See Our Institutional Insights

Stay on top of the latest investment trends and developments with our views and research.