Personal Wealth Management / Politics

Investing Lessons From the Year Since 2020’s Vote

With midterm elections looming, stay above the political fray.

Editors’ Note: MarketMinder favors no politician nor any political party, assessing developments and trends solely for their potential market and economic impacts.

This week marked a year from the contentious 2020 US presidential election. Along the course, we have endured 12 months of hot, shrill rhetoric over contested outcomes and recounts, twin Georgia Senate runoff votes, a riot at the Capitol, lots and lots of talk about big legislation and so much more. Regardless of which side of the aisle you favor, there was something to trigger your emotions. Now 2022’s midterms are coming into focus, which could roil emotions again. In our view, that makes now an apropos time to remember: Mixing political bias into your investment strategy is dangerous.

Last year at this time, many on America’s political right warned President Joe Biden’s winning would spell big trouble for stocks. They doubled down on this argument when it became clear both Georgia Senate seats would be up for grabs on January 5. That raised the possibility of the Democratic Party controlling the White House and both chambers of Congress, which many presumed meant huge legislative activity was coming, drawing some investors’ hope—and many others’ ire.

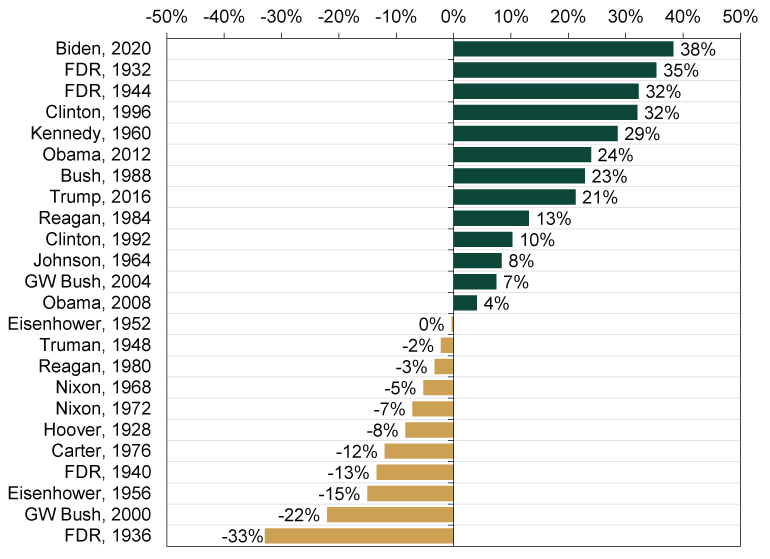

Flash forward to now. Biden won the election. Both Georgia Senate seats went to the Democratic candidates, too. But did this spell trouble for stocks? As Exhibit 1 shows, the answer is a resounding “no”—US stocks have posted their best post-election return since good daily data start in 1928.

Exhibit 1: S&P 500 Returns One Year After Presidential Elections

Source: FactSet, as of 11/4/2021. S&P 500 price returns one year after Election Day of president indicated, 1928 – 2021.

Now, those on America’s political left may see this—and the collection of names toward the top of this bar graph—as evidence suggesting Democratic presidents are “better for stocks.” We often see this very theory trotted out during election years, based on averages or other selective views of market history.[i] But ascribing returns directly to a president—any president—in this manner is fallacious, in our view. Last year illustrates it perfectly.

For one, slicing market returns like this obscures the overall cycle—and could lead to errant conclusions. The 38% return a year from Biden’s election as president may seem huge, and it is big. However, in broader context, it doesn’t seem so remarkable. The year happened to fall in the wake of history’s fastest-ever bear market last spring—and among the fastest rebounds on record. Consider: Between March 23, 2020’s low and November 2, 2020—the day before election day—the S&P 500’s annualized return was 89.4%.[ii] The biggest-ever post-election 12-month return represents a marked slowdown from the trend immediately preceding it.

But at a broader level, because stocks move most on the gap between reality and expectations, widespread fear and relief can greatly influence stocks’ direction. Entering this year, many, many investors feared a Democrat-controlled government would spell trouble for stocks. But the Biden administration has proven unable to do much due to intraparty squabbling. For those who feared sweeping legislation or action earlier this year, that is likely a big relief—conscious or unconscious. Ditto for his approval rating’s drop from 57% in late April to 42% in mid-October and the GOP’s relatively strong showing in this week’s gubernatorial elections.[iii]

This all fits with our long-held view of how sentiment can sway stocks in election and inaugural years—the perverse inverse. Counterintuitively to many, inaugural year returns under Democratic presidents top GOP presidents’. Why? Fear and relief. Democrats seeking the White House often campaign on higher taxes, regulation and other measures many investors see as “anti-business.” Republicans normally campaign on the opposite. So when Democratic presidents take office, fears over what they may do run wild early in the inaugural year. However, most presidents (whether by choice or not) moderate once in office. (The slim margins in Congress right now seem to be forcing that, at least in part.) As this inaugural year reality unfolds, it usually fails to live up to pre-existing fears already baked into stock prices. Hence—consciously or unconsciously—relief takes hold. The positive surprise helps lift sentiment, driving bigger returns.

A year from now, we will be talking about a different election—the 2022 midterms, which are already drawing a ton of attention. These midterms will have their own effect on stocks, which we are sure to discuss in the coming months. But we think you can also book this: Pundits will overrate personalities and rhetoric, with many shrill claims about what this-or-that outcome means for your money. Tune it all down. From a market perspective, viewing politics correctly requires staying above the biased fray, in our view—separating talk from probable outcomes.

[i] For one example, see “The Stock Market Does Better When Democrats Are in the White House,” Casey Bond, Huffington Post, 10/13/2020 or “Stocks Perform Better When a Democrat Is in the White House. History Proves It,” Matt Egan, CNN, 9/23/2020.

[ii] Source: FactSet, as of 11/4/2021.

[iii] Source: Gallup, as of 11/4/2021. Presidential Approval Ratings—Joe Biden.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.