Personal Wealth Management / Politics

The US Election and Your Money

Stocks don’t really care who’s president. They’re neutral, objective, unbiased—just like investors should be.

Editors’ Note: Our discussion of politics and elections is focused purely on potential market impact. Stocks favor neither party. Believing in the market/economic superiority of one group of politicians over another can invite bias—a source of significant investment errors.

Here is a common statement in US presidential-election years: “I hope So-and-So wins because So-and-So is exactly what the economy needs to start growing fast again! So-and-So would be better for stocks!”

Already, in the primaries and now the general election, the candidates have been spouting off about what they will do to get the economy growing faster once they’re in the White House. At the same time, we’ve seen a fair amount of hypothesizing on which candidate or party will be best for the economy and stocks.

Yet neither campaign promises nor party affiliations have such a huge influence. Most pledges either never come to fruition or are heavily watered down. What’s more, politics is only one factor of many driving market returns. Love or loathe any candidate’s economic proposals, making investment decisions based solely on the personality or party controlling the White House is a prescription for errors.

Campaign Pledges Rarely Become Reality

In elections around the world, investors regularly cheer or jeer every new government—depending on their political leanings—thinking it will be either economic magic or poison. But, at least in the US, for good or ill, most candidates’ campaign pledges never become reality. Just consider the last four presidents. Barack Obama planned to jumpstart a renewable-energy boom while imposing a windfall profits tax on oil companies. George W. Bush (Bush 43) proposed partially privatizing Social Security and paying down a chunk of the federal debt. Bill Clinton sought national, single-payer health care, support for factories and increased manufacturing employment. George H. W. Bush (Bush 41) aimed to keep taxes low.

None of these initiatives happened. Solyndra, the Obama administration’s green darling, went bankrupt (along with a few others) and that windfall profits tax was blown away. Social Security is as public as ever, and US debt rose under Bush 43. Factory jobs fell under Clinton, and national healthcare reform didn’t come until 18 years after his election—and only then in a very watered-down form. Bush 41 famously violated his signature pledge of “Read my lips. No new taxes!” Anyone basing investment decisions solely on these folks’ flagship campaign pledges would have been sorely disappointed.

Despite this history, partisan bias often leads investors to overrate politicians’ promises—and their impact. Many Americans who favor the Republican Party, taking traditional campaign rhetoric at face value, believe their party is inherently pro-business and therefore better for stocks—and that Democratic presidents tend to be bad for stocks. Democratic-leaning investors, by contrast, cite strong returns under Democratic presidents to support their bullishness, noting the historically subpar results under Republicans.

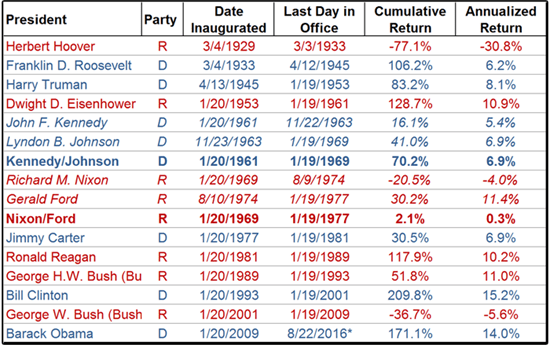

Consider the Past: Market Performance by Presidential Administration

Contrary to common fears, no party is “bad for stocks.” Democratic administrations have coincided with fine returns, gutting the notion they are bad for stocks. Since 1926, in years the US has had a Democratic president, stocks rose 79% of the time.i But then again, Republican administrations coincide with positive returns most of the time (67%), too. ii A strict comparison may seem to favor the Democratic argument, but that is far too narrow a view. While neither Democrats nor Republicans are categorically “bad for stocks,” the data can’t and don’t prove either party’s superiority.

Exhibit 1: Returns by President/Party

Source: Global Financial Data, Inc., as of 08/23/2016. S&P 500 price returns, 03/04/1929 - 8/23/2016. We present this information with Kennedy/Johnson and Nixon/Ford separate (italicized) and combined (boldface), as these administrations each sum to one eight-year period of uniform party control, despite the non-election change in president.

Returns shown are in US dollars. Currency fluctuations between the euro and dollar can affect returns.

*This is the latest completed date, as Obama will be in office until 01/19/2017.

Republican Presidential Periods

Take President Herbert Hoover’s returns. (And don’t bring them back, please.) Markets fell a lot under him as his presidency was during the Great Depression. And he made some mistakes, for sure. (Signing the Smoot-Hawley Tariff Act of 1930 was chief among them.) But as legendary economists Milton Friedman and Anna Schwartz showed in their seminal work, A Monetary History of the United States, the Fed’s overly tight monetary policy was the primary culprit for the massive economic downturn and -77.1% S&P 500 returns from 1929-1933. This theory is widely accepted today. Former US Federal Reserve Chairman Ben Bernanke put it well in concluding a 2002 speech celebrating Friedman’s 90th birthday:

Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve. I would like to say to Milton and Anna: Regarding the Great Depression. You're right, we did it. We're very sorry. But thanks to you, we won't do it again.

Franklin D. Roosevelt’s returns might look wonderful—and they are far better than Hoover’s—but he was in office 12 years. When you compare annualized returns during his presidency (6.2%), they trail returns under George H. W. Bush (Bush 41, 11%), Ronald Reagan (10.2%) and Dwight Eisenhower (10.9%). iii Moreover, Reagan took office on the cusp of a bear market that began under Jimmy Carter. And George W. Bush (Bush 43) took office in 2001, 10 months into the dot-com bear market, which began in Bill Clinton’s last year in office. While we believe the Bush 43 administration’s haphazard response to the global financial crisis contributed to the depth of the downturn in 2008, FAS 157 (the mark-to-market accounting rule implemented in 2007 that forced banks to incur major losses on illiquid assets, regardless of their viability) wasn’t a Bush 43 administration-led policy—it was a rule passed by the Financial Accounting Standards Board, a body designed to be independent of administration directives.

Democratic Presidential Periods

Markets soared under Clinton, but this was largely due to a technology boom he had little to do with. The beginnings of the Internet’s commercialization spawned a boom in personal computers, e-commerce and internet infrastructure. Further, Clinton dealt with gridlock from 1994’s “Republican Revolution” through the close of his presidency. Similarly, while markets have done well under Obama (annualizing 14.0%), consider: He has operated under gridlock since January 2011, and he came to office near the trough of one of history’s worst bear markets. It isn’t possible to know for sure what would have happened had John McCain won. Maybe the bounce would have been bigger. Or smaller. Or the same. After all, when bear markets end, stocks historically tend to bounce big.

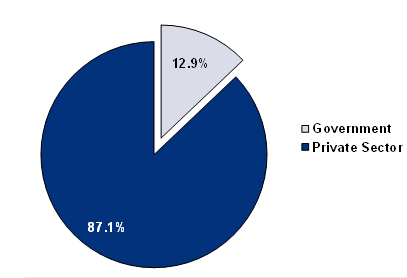

The Private Sector, Investor Sentiment and Other Market Influences

Maybe this last point strikes you as odd, but consider: The ultimate reason partisan thinking is wrong in investing is that America’s economy is dominated by the private sector. (See Exhibit 2.) The bulk of our economy is outside the control of the folks in Washington, DC. Perhaps that strikes you as blatantly obvious. That’s fine, but thinking the president you love or hate is going to fundamentally alter the course of hiring, output, wages, exports, stock prices or anything else overlooks this point. What’s more, the US is only about 25% of global GDP today. That means 75% of world economic activity isn’t subject to US administration policies,iv whatever they are. Finally, equity-market returns are often the result of how sentiment compares to reality. If investors generally fear President So-and-So will be awful for stocks, anything better than awful will be a positive surprise. That may not be the most patriotic sentence you’ve ever read, but markets are unemotional.

Exhibit 2: Private Sector and Government Share of US GDP, as of 2015

Source: FactSet, US Bureau of Economic Analysis, as of 08/23/2016. 2015 annual data are the latest available as of this writing.

None of this is to say politics and presidencies are irrelevant. As a major driver of stock returns, it would be foolish to conclude there is no impact from government. Politicians can affect market direction by passing sweeping legislation. Or they might influence performance at the sector level. From 2009 through early 2011, while the Affordable Care Act debate and initial passage created uncertainty, Health Care stocks lagged the US market. But after it became reality, stocks moved on and Health Care outperformed.

There is also a big impact on sentiment in election years. Typically, US markets post above-average returns in years a Republican wins—as the Republican-leaning investor class anticipates a business-friendly administration. When they turn out to be politiciansv post-inauguration, disappointment tends to weigh on returns. Election-year returns tend to be below average when Democratic candidates win, but rebound on relief when they prove to be politicians,vi too. This year, we have a weird election with an outsider as the Republican nominee, pitted against a well-known Democratic nominee, making us wonder if these trends apply—a factor we’ll continue weighing as this year progresses.

We have no idea today who will win the White House in November. But we do know that whomever Americans vote for isn’t hugely relevant to how you should invest. When it comes to assessing markets’ likely direction, you must shun political bias.

i Source: Global Financial Data, Inc., as of 08/23/2016. S&P 500 Price Index frequency of positivity when a Democratic president is in office, 1926 - 2015.

ii Ibid. S&P 500 Price Index frequency of positivity when a Republican president is in office, 1926 - 2015.

iii Source: Global Financial Data, Inc., as of 08/23/2016. S&P 500 price returns for the administrations indicated.

iv Except, of course, where international trade is concerned.

v Read: liars.

vi Ibid.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments has developed several informational and educational guides tackling a variety of investing topics.