Business 401(k) Services / 401(k) Plan Optimization

What Business Owners Should Know Before Starting a 401(k)

Did you know there are major tax advantages to starting a 401(k)? Find out what they are and find out what other questions you need to know.

Starting a 401(k)

Fisher Investments® 401(k) Solutions

Upbeat music

A woman dressed in a polka-dot blouse and black blazer. A flyout in the lower left corner identifies her as Kimberly Ellis Product Development Team Leader

The volume of the music is reduced.

Female Voice: "Starting a retirement plan is one of the most impactful things that a business owner can do to help mitigate their tax liability."

"Here at Fisher Investments, we specialize in helping business owners, design retirement programs that are specifically tailored to help them achieve their unique tax savings and retirement savings goals. Here are just a few common questions that we get when helping our clients design retirement programs."

The flyout disappears. The camera remains focused on the speaker, occasionally zooming in or out.

"A common question that we get from business owners when we're helping them design a retirement program is: what's the best plan type for me?"

"Well, there are several plan type options for business owners looking to start a retirement program: a SEP IRA, a SIMPLE IRA, a 401(k) plan, or even a state sponsored retirement plan."

"Each of these plan types has pros and cons and can feel a little overwhelming for a small business owner."

"At Fisher Investments, we specialize in helping business owners navigate this complicated landscape, helping them decide on what plan type is best for them, their business and most importantly their goals."

"Another question we often get from business owners who are starting retirement programs is: how can this retirement plan help me reduce my tax liability?"

"There are two main ways that starting your retirement plan can help business owners reduce their tax liability."

"The first way, is through an IRS tax credit. Did you know that businesses who start a retirement plan are eligible for a tax credit of up to $5,500 per year, every year for the first three years of that retirement plan?"

"The second way that a retirement plan can help a business owner reduce their tax liability is through the contributions. As a business owner, you can make personal contributions as well as employer contributions into a retirement plan. These contributions are tax deductible and they grow tax deferred."

"Another question we often get from small business owners looking to start a retirement program is how can Fisher Investments help me?

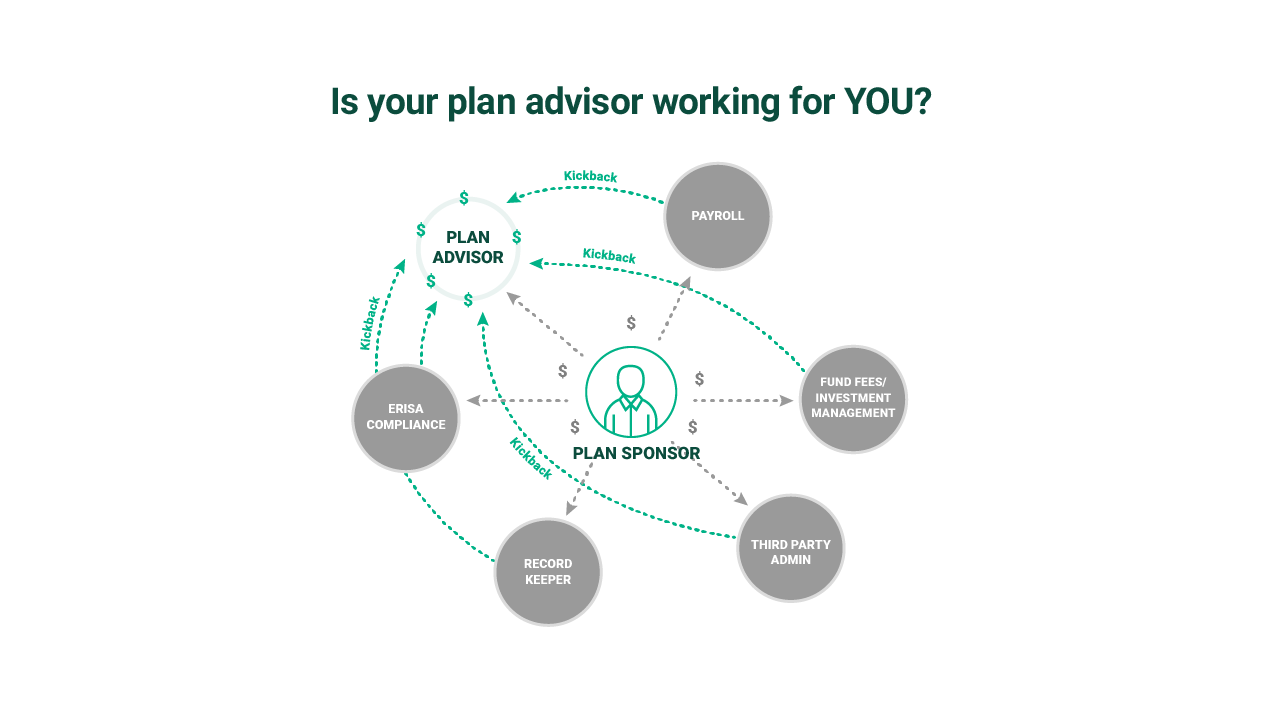

"Fisher Investments specializes in helping small business owners navigate the complexities of the retirement plan industry acting in the best interest of our clients. So when our clients do better, we do better."

The screen dissolves to white.

Fisher Investment 401(k) Solutions logo fades on to the screen.

The volume of the upbeat music increases.

Fisher Investments 401(k) Solutions. © 2021 Fisher Investments. Investing in securities involves the risk of loss. Intended for use by employers considering or sponsoring retirement.

The music continues to play.

The screen fades to black.

The music fades out.

See our Business 401(k) Insights

Resources and articles to help your business with retirement plan support, optimization and administration.

Contact Us

One of our 401(k) business specialists would love to talk to you about your company's retirement plan needs.