Business 401(k) Services / Video Commentary

Not All Retirement Plan Advisors Are the Same

When hiring a plan advisor, you typically have three options; a 3(38) investment manager, a 3(21) or a non-fiduciary advisor. It’s important to understand the differences so you can select the option that best aligns with your retirement plan needs. Learn the roles of each type of plan advisor and what makes Fisher 401(k) Solutions' fiduciary services different from other plan providers.

Transcript

Fiduciary Services

Fisher Investments®

Upbeat Music

A man dressed in a suit speaks to the camera. A flyout in the lower left corner identifies him as Ian Epstein, National Director of Retirement Plan Consultants

The volume of the music is reduced.

Male Voice: “What is a Fiduciary?

A retirement plan fiduciary is a person or company that is legally required to make decisions that are in the best interests of a retirement plan.”

A white background flies in from the left appears with green text that reads:

When hiring a plan advisor, you typically have three options:

1. Hire a 3(38) Investment Manager

2. Hire a 3(21) Plan Advisor

3. Hire a Non-Fiduciary Investment Advisor

The flyout stays on screen for several seconds and then disappears.

When hiring a plan advisor, you typically have three options:

Hire a 3(38) Investment Manager

Hire a 3(21) Plan Advisor

Hire a Non-Fiduciary Advisor

A white background appears with a chart with 4 columns that read:

Non-Fidudciary Plan Advisor, 3(21) Plan Advisor (Co-Fiduciary), Typical 3(38) investment Manager (Fiduciary) and Fisher 3(38) Investment Manager (Fiduciary Plus)

The flyout stays on screen for several seconds and then disappears.

“A 3(38) Investment Manager takes on the full responsibility of managing the investment lineup and has discretion to make necessary changes. In doing so, the 3(38) Investment Manager takes on the primary fiduciary responsibility for investment decisions and is legally obligated to make decisions in the best interest of their clients.”

“A 3(21) Plan Advisor makes investment recommendations but leaves the ultimate decision and liability to you. A 3(21) Plan Adviser shares some of your legal liability by acting as a co-fiduciary.”

“A non fiduciary advisor works for an insurance or investment company, recommends investments thay they believe are suitable to you as their client, but they aren’t held to the same standard as a fiduciary.”

A white background flies in from the left appears with green text that reads:

Why is it important to hire a 3(38) Investment Manager like Fisher?

The flyout stays on screen for several seconds and then disappears.

“Why is it important to hire a 3(38) Investment Manager like Fisher?”

The camera goes back to the man as he continues to speak.

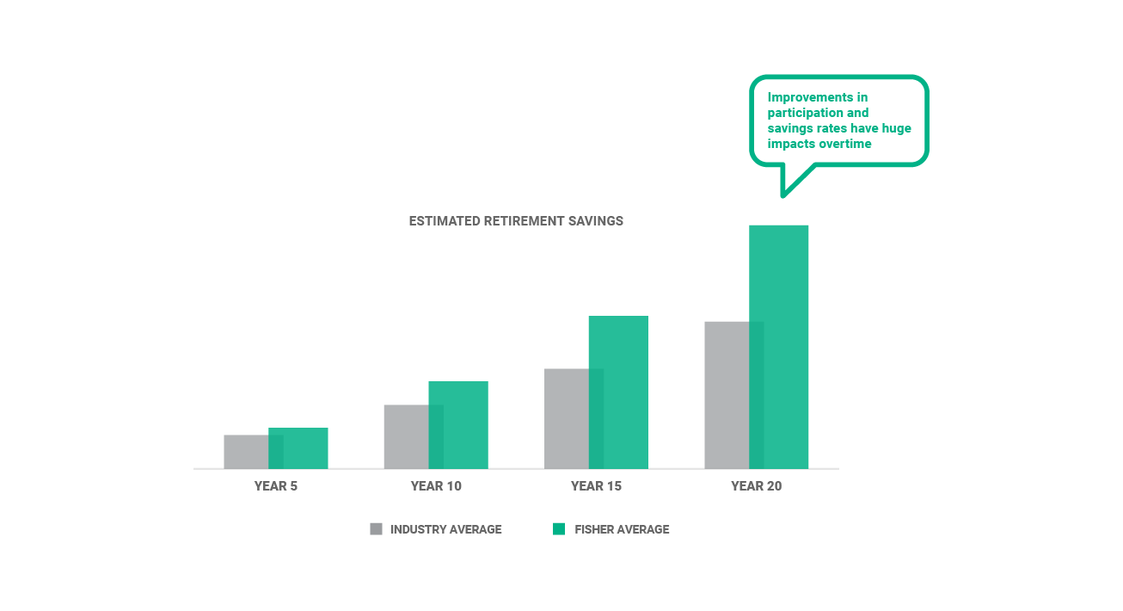

“We constantly monitor fund performance because few funds stay at the top of their category over time. For example, over a single five-year period, only about 15% of domestic equity funds that performed in the top half of their category in 2017 were able to maintain that status annually through 2021.”

A white background flies in from the left appears with green text that reads:

· Incentive structures that are aligned with your success

· Help creating and maintain a fiduciary audit file

· Fiduciary education for the plan committee

The flyout stays on screen for several seconds and then disappears.

“Fisher also offers additional services that many other 3(38) Investment Managers don’t provide like”

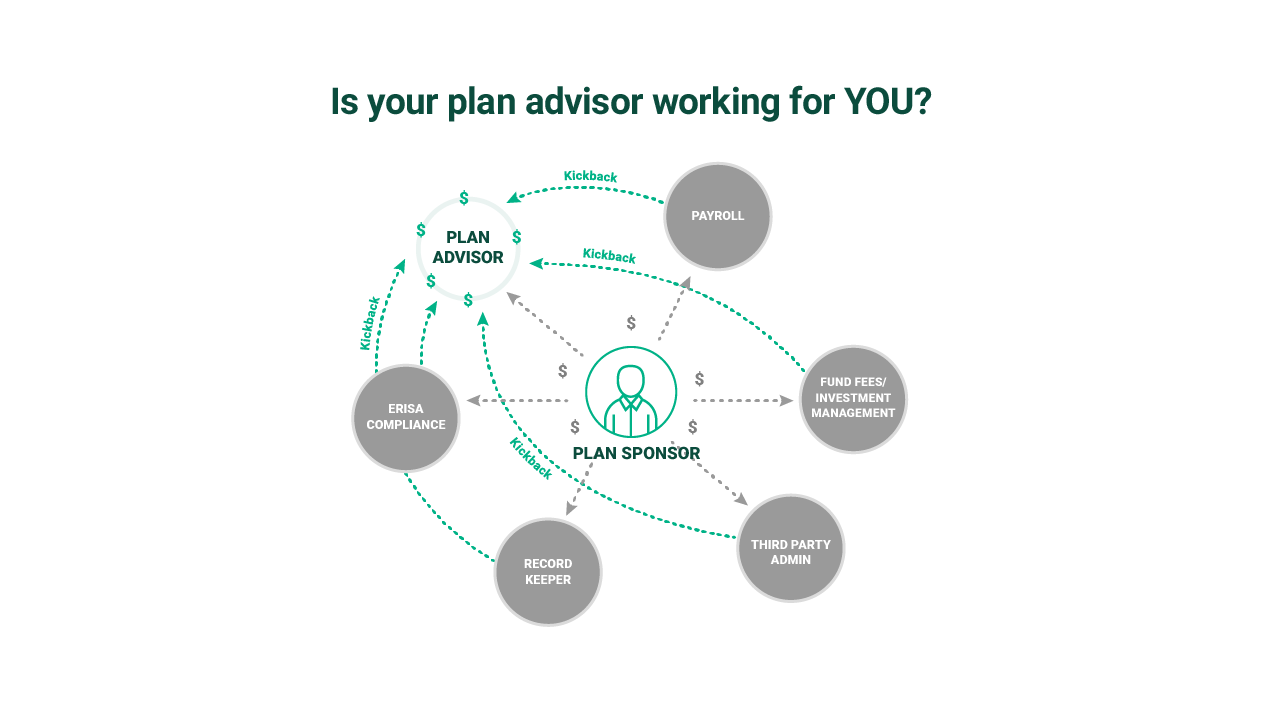

· Incentive structures that are aligned with your success (no revenue sharing)

· Help creating and maintain a fiduciary audit file

· Fiduciary education for the plan committee

The camera goes back to the man as he continues to speak.

“Fisher works for you—not for kickbacks—and puts our focus on growing your wealth. Fisher won’t compromise your earning potential to make a quick buck. We focus on quality over the long term because we understand how big a difference this approach makes for you when it’s time to retire. “

A white background slides in from the right.

Fisher Investment 401(k) Solutions logo fades on to the screen.

The volume of the upbeat music increases.

The music fades out.

The screen fades to black.

See our Business 401(k) Insights

Resources and articles to help your business with retirement plan support, optimization and administration.

Contact Us

One of our 401(k) business specialists would love to talk to you about your company's retirement plan needs.