Personal Wealth Management / Financial Planning

Some Reminders as Tax Year 2020 Winds Down

A rundown of tax information to help you organize your thoughts as this tax year nears its end.

Presently, November 3 is the date that seems to dominate most investors’ minds. But not so far behind it lies another date of some importance to investors: December 31. Yes, 2020 is coming to a close[i], and with it the books on the tax year. With that in mind, here is a quick roundup of some pre-yearend considerations for investors.

Tax Loss Harvesting

While you may have already addressed this, if you realized capital gains (meaning, you sold a security at a profit) this year, it may behoove you to review your portfolio and find positions you currently hold that are at a loss. If this is you, you may wish to consider selling the security to realize the loss. Realized losses can offset gains dollar for dollar, limiting your potential capital gains exposure. Alternatively, you can deduct up to $3,000 in losses from your income (reducing tax exposure there). If by chance your realized losses exceed your gains, you can carry them into future years and use them to offset realized gains.

Note: This is exclusively a tax-mitigation maneuver, in our view. It isn’t “selling the dogs,” which is tantamount to selling a down stock because you think its past performance portends trouble ahead. (It doesn’t—past performance alone isn’t predictive.) It also isn’t about reducing stock market exposure or raising cash, in our view. We think tax-loss selling is properly done by identifying stocks purchased more than 30 days ago that are at a loss, selling them and buying a replacement security with the proceeds that aims to maintain thematic exposure. Then, 30 days after selling, reconsider—in some cases, it is beneficial to hold the replacement. In others, it makes more sense to sell it and buy back the original position.

A final note: That 30-day before-and-after window is important. This is the wash-sale period. Sell something you acquired too soon—or buy it back too quickly afterward—and the IRS will disallow the loss. For more on this, talk to your tax professional or visit here.

Bitcoin!

We can’t be sure how many readers really transact in Bitcoin or cryptocurrencies, but they are certainly items of interest in the financial press. To that end, it is worth remembering their tax quirks—and noting the special attention the IRS is paying to them starting this year.

For tax purposes, the IRS considers Bitcoin and other cryptocurrencies property—not currencies. Seem semantic? If so, allow us to disabuse you of that notion. It means any disposition of cryptos—sales, transfers, payments to vendors, etc.—is potentially a taxable transaction, with gains taxed. That is potentially problematic because not all cryptocurrency firms’—or investors’—record-keeping is robust.

Rightly or wrongly, the IRS has become convinced that people are massively underreporting taxable activity with respect to cryptocurrencies. One accounting firm that deals with cryptoclients estimated fewer than 150,000 Americans filed appropriately last year.[ii]

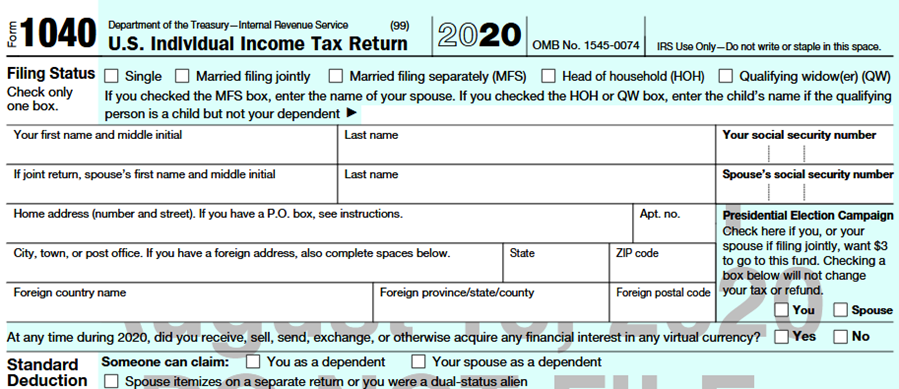

If you know anything about the IRS, or even nothing but its reputation, it is likely obvious the agency won’t stand for that. So this year, they added a question to page 1 of Form 1040 just under the name and address fields. (Exhibit 1)

Exhibit 1: The IRS Really Wants to Know About Your Bitcoin

Source: Internal Revenue Service, as of 10/21/2020. Sample 1040 form for 2020.

So look, we don’t recommend you transact in Bitcoin. But if you do, we strongly suggest you keep good records and report your transactions accurately. Get help from a tax professional if you must. Don’t say we didn’t warn you.

Gold, Silver and Metals Holdings

In a similar vein, many investors may be unaware of the quirks to holding gold or silver—both popular assets this year. These assets aren’t considered securities by the IRS. They are collectibles, which subjects them to different tax rules.

Realized gains in gold and silver don’t qualify for capital gains treatment. If you sell gold or silver assets you have owned in a taxable account for more than a year, any gain won’t get the typically lower long-term capital gains rates (15% or 20%, depending on your bracket). Instead, gains are taxed at ordinary income rates up to a cap of 28%.[iii] This of course applies to collectible coins, but also to exchange-traded funds (ETFs) that invest in gold or silver.

Mutual Fund Capital Gains Distributions

Over the next few weeks, many mutual fund companies will begin unveiling 2020 capital gains distributions to shareholders—a taxable event for those who hold fund shares outside of retirement vehicles. This year is likely to prove noteworthy, too. Here is why.

Mutual funds are required by law to pass through nearly all of the fund’s realized gains to shareholders proportionately. Now, when volatility strikes, frightened investors often redeem en masse. That can force a fund manager to sell to raise cash, regardless of what they may want to do. In the process, the manager may realize big gains.

While it is too early to say for sure, this year could have triggered a very large amount of realized gains. Through the year’s first nine months, investors redeemed a net $221 billion from equity mutual funds—the biggest total through September in the last 20 years.[iv]

Now, maybe these managers raised cash and at least partially offset gains with losses. But after a nearly 11-year bull market run, it wouldn’t shock us if these redemptions forced the realization of quite a bit of gain. If you own funds in a taxable account, this may be something you want to watch out for as fund companies release estimates over the next few weeks. That applies regardless of whether the fund rose or declined this year.

Quite obviously, our little run-down of oddities is the tip of the tax iceberg. But it hopefully serves as a small reminder that the year is ending soon—don’t wait too long to make any tax moves that may be beneficial.

[i] We assume you won’t be too upset to see it go.

[ii] “The IRS Is Adding a Cryptocurrency Question to Form 1040,” Jeff John Roberts, Fortune, September 28, 2020.

[iii] “Investing in Gold—Tax Considerations,” Steven H. Smith, PhD and Ron Singleton, CPA, PhD, The Journal of Accountancy, January 1, 2015.

[iv] Source: FactSet, as of 10/21/2020. Investment Company Institute cumulative net new cash flows to equity mutual funds (monthly) through the year’s first nine months, 2000 – 2020.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.