Personal Wealth Management / Politics

Weighing Trump’s First Year From a Market Perspective

Here is a review of what did—and didn’t—happen in the 45th President’s first year in office.

As a reminder, our political analysis is nonpartisan and focuses exclusively on political developments’ potential market impact (or lack thereof). We favor no party, politician or ideology and believe political biases lead to investing errors.

On January 20, 2017 Donald Trump was inaugurated as the 45th President of the United States. Depending on who you asked, it was either the best thing to happen since the moon landing or the beginning of Armageddon. On the positive side: Trump was going to “drain the swamp”; free business from regulatory burdens; MAGA! On the negative side: Trump was a dangerous protectionist; dictator-in-waiting; unfit for office; a “bad hombre,” as it were. One year later, reality suggests Trump is like most presidents: He did less than the hopeful folks hoped and less than the fearful folks feared. Markets, meanwhile, saw through the noise and moved higher. In our view, the past year demonstrates why it is critical for investors to separate their personal biases from their investment decisions.

What Happened

Here is a non-exhaustive recap of what happened under Trump.

Tax Reform

While Trump promised big, sweeping change on the 2016 campaign trail, he and the GOP-led Congress ended 2017 with only one major legislative accomplishment: tax reform. Washington focused first on health care reform, but Congress failed multiple times to get the votes necessary to overhaul the Affordable Care Act (ACA). In August, they turned their attention to tax reform. Over the next three months, Congress crafted, revised and ultimately passed a bill Trump signed before Christmas.

As with any legislative change, the tax bill creates winners and losers (see our detailed thoughts here). However, tax changes’ market impact is overstated, whether Congress cuts or hikes. Tax code changes aren’t implemented in secret—they tend to be loud fights as pols seek to appease their constituents. Plus, any agreement is usually rolled out gradually, not suddenly. These factors allow markets to price in the change, sapping any potential surprise power. While finalizing tax reform could boost sentiment since it removes some uncertainty, the market impact isn’t as sweeping as many think.

Trade

President Trump started the year with a bang by exiting the Trans-Pacific Partnership (TPP). His administration also started renegotiating NAFTA—aka, the “worst trade deal ever made”—in August. Beyond that, the president has threatened different countries (e.g., China and Canada) with punitive tariffs in the name of American interests. While dramatic, none of these moves fundamentally altered the status quo. Congress—which must ratify any new trade deal—wasn’t likely to approve TPP anyways, so Trump’s announcement was a formality. NAFTA talks are dragging on amid heavy talk, but that is typical of trade negotiations. We suggest waiting to see the result rather than speculating over the horse trading. Trump’s tariff threats aren’t atypical, either. His predecessors—Democratic and Republican alike—have issued tariffs before, and they didn’t lead to economic calamity.

Executive Orders and Other Presidential Powers

Like his predecessors, Trump used executive authority to push his agenda on a variety of issues and influence the national discourse. Many of his Executive Orders on issues like immigration, along with decisions like leaving the Paris Agreement, caused a whole lot of handwringing in the media. Yet most changed next to nothing, and many amounted to orders for various agencies to study some issues and report back with recommendations for Congress. Those that did alter policy were primarily confined to sociological issues, not economic—and the courts blocked many. While lots of these issues are important and can affect people’s lives, they don’t meaningfully impact stocks’ primary drivers—important for investors to remember.

What Didn’t Happen

Even though Trump dominated the news cycle in 2017, what didn’t happen is more noteworthy.

False Fears

Nearly all of the fears surrounding Trump haven’t manifested. Remember when Trump the authoritarian was going to run roughshod over democracy and install autocratic rule? Turns out the Founding Fathers’ checks and balances system is pretty resilient (see the above-mentioned feckless Executive Orders). Bureaucracy is doing its thing as federal agencies are following procedures to move slowly and solicit public commentary. Courts are weighing in. Even Energy Secretary Rick Perry couldn’t push through his plan to subsidize the coal industry as the Federal Energy Regulatory Commission—a five-member commission that includes four people appointed by President Trump—rejected it. Intraparty gridlock prevented much new legislation from passing. And unlike some of his predecessors, Trump didn’t respond by doing an end-run around Congress with pen and phone.

On the international front, Trump’s tough trade talk didn’t cause a global trade war. According to some supranational organizations, global trade actually grew last year. A hot war didn’t erupt, either, despite angry words, missile tests and a wide array of tweets. Perhaps he changes course going forward, but so far, there is little evidence suggesting a broad US-triggered trade war is likely. Trump’s election also didn’t start a new wave of populist-type candidates ushering in a new global order—see Holland’s Geert Wilders and France’s Marine Le Pen for more.[i]

Unfulfilled Promises

While many political pundits said Trump was different, the president sure acted like any other politician in walking back campaign pledges. GOP-Candidate-for-President Trump promised to label China a currency manipulator on Day One of his presidency—a move that could allow for punitive measures. However, since taking office, Trump’s Treasury Secretary had “a terrific conversation” with Chinese officials, and China remains free of the designation. Though media made much of the Trump Administration labeling China as a “strategic competitor” in its National Security Strategy in December—earning criticism from Chinese analysts and state media—these words are political posturing, not economic policy changes.

Though Trump promised to lead a deregulatory charge to free up business, most of these changes are small tweaks, not yuuuuge cuts. Out of the 1,000 regulations struck from existence, 860 of them were only proposed—they weren’t even on the books yet. While the Trump Administration has issued fewer rules overall, that isn’t the same as releasing businesses from their regulatory shackles. Trump talked up a $1 trillion infrastructure spending plan that looks far from reality. Even on smaller issues—like bringing back coal—his progress here has been spotty at best.

What Stocks Did: Ignored the Noise

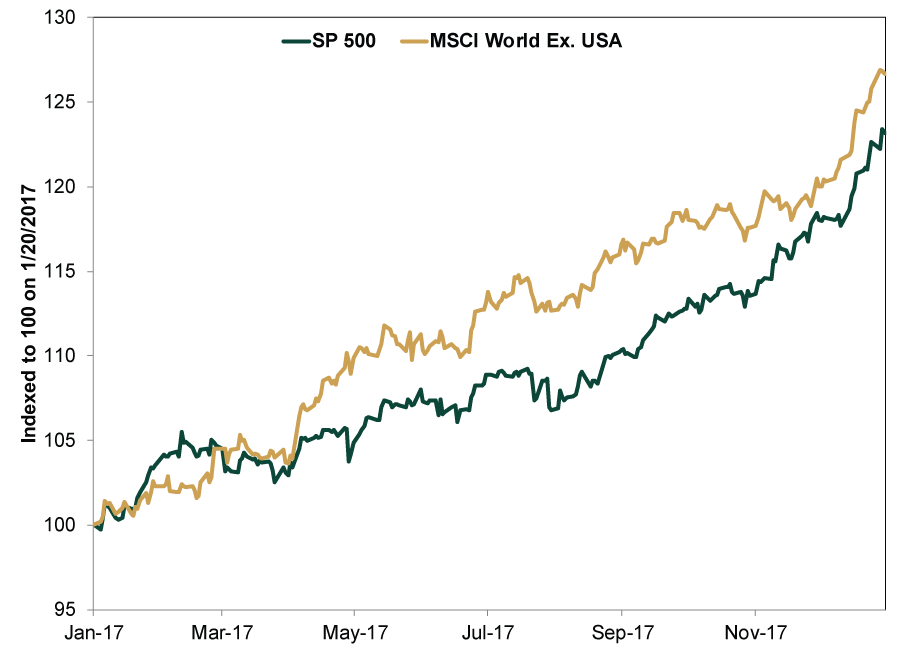

Through the spectacle, stocks—the best discounter of (real or fake) news—have risen higher. From January 20, 2017 – January 18, 2018, the US’s S&P 500 is up 25.7%.[ii] Grand! But lest you credit the White House for those returns, consider the MSCI World ex. USA gained 26.7%.[iii] Grander! Considering US politics aren’t super meaningful for markets ranging from Spain, the Netherlands or Hong Kong, we’d suggest this shows the global bull market’s positive drivers matter a wee bit more.

Exhibit 1: US vs. Non-US Stocks Since Trump’s Inauguration

Source: FactSet, as of 1/18/2018. S&P 500 Total Return Index and MSCI World Ex. USA Total Return Index with net dividends, 1/20/2017 – 1/18/2018. Indexed to 100 on 1/20/2017.

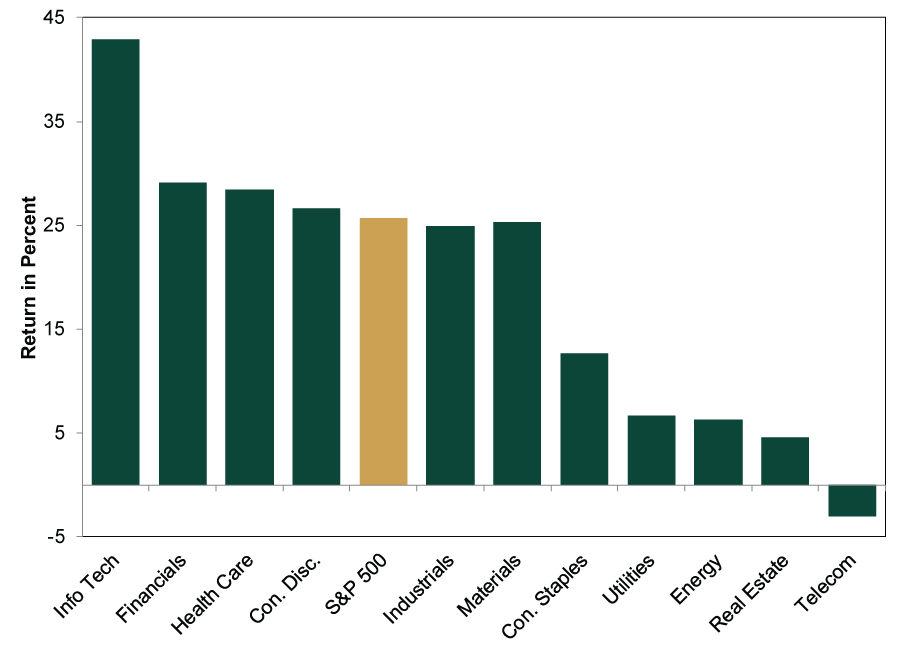

Remember how President Trump’s policies were supposed to help certain industries? Deregulation was going to benefit Financials; infrastructure spending would boost Materials; defense spending would help Industrials zoom; friendlier policies toward fossil fuels would set off Energy stocks; drug price caps would haunt Health Care. But reality told a different story.

Exhibit 2: S&P 500 Sector Returns Since Trump’s Inauguration

Source: FactSet, as of 1/19/2018. S&P 500 Sector Total Returns, 1/20/2017 – 1/18/2018.

Information Technology had the best sector returns in 2017, even though Tech executives have arguably had the most contentious relationship with the President—and many presumed his hostile stance toward immigration hurt Tech most of all. We aren’t arguing going against the White House is a bullish move. Rather: Don’t base an investment decision exclusively on what potential White House policy may be. Invest on probabilities, not possibilities.

Looking ahead, US politics likely remain loud and noisy, but we don’t envision much legislative change. The GOP spent most of its political capital on tax reform. With midterms looming in November, Congress isn’t likely to rock the boat too much. While the media and Trump’s adversarial relationship likely continues, don’t let the noise influence your investment decisions. Instead, we’d suggest trusting the market—it knows bombast is highly unlikely to derail stocks.

[i] Or perhaps you can ask them directly. They didn’t win their respective races, so they probably have more time.

[ii] Source: FactSet, as of 1/18/2018. S&P 500 Total Return Index, 1/20/2017 – 1/18/2018.

[iii] Ibid. MSCI World ex. USA Total Return Index with net dividends, 1/20/2017 – 1/18/2018.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments has developed several informational and educational guides tackling a variety of investing topics.